For Nonprofit Revenue Resilience, Retention is Everything

Quick summary:

Retention compounds growth in two directions: It makes donor acquisition more efficient and it grows a major donor pipeline.

Retention is in the zone of an organization’s direct control. It’s largely dependent on owned media and audiences and isn’t subject to big increases in external factors like digital ad rates and algorithm changes.

If you’re at an organization that hasn’t focused on retention metrics in a while (or ever), retention improvements can be a foundation for revenue growth.

If you're in a nonprofit revenue role (marketing or fundraising) with a mass donor program, you're probably familiar with some version of this scene: The CMO or Head of Development drops in with a fire-drill: 'Team, we need more donors and we need them yesterday.' If you're on the marketing team, how do you respond? 'Sounds like an opportunity for...a campaign! Let’s spin up the creative team, send a RFP to our agency and scrape the bottom of the barrel of our paid media budget!’

In this scramble to plug the hole in the boat, it’s tempting to jump straight to acquisition. We need fresh blood, more donors, new donors, young donors. But there's another option that's likely to be more impactful on overall revenue growth in the long run, and that's beginning the hunt for growth with a renewed focus on retaining the donors that have already given multiple times. Excellence in retention is the key to unlocking revenue growth.

What counts as retention?

When I talk about retention, I’m not talking about one-time donors who never gave again. These are donors who never fully bought in to your mission, never saw the impact, never made a commitment. These are donors that were never ‘activated’, which is a different problem to solve.

I’m talking about donors that, after their first gift, converted to a recurring program on a standard schedule (monthly, quarterly, annually) and have given for multple cycles. These are donors who have raised their hands and said, ‘Yes, I’m in. I’m going to be a long-term contributor to solving this problem with you.’ Retention metrics apply to this group.

Retention is the foundation of a sustainable mass-donor fundraising program.

Going back to our earlier analogy, a focus on acquisition with poor retention metrics is the fundraising equivalent of bailing water out of a leaky boat. Far better to fix the hole first, because every pail of water you throw overboard from then on means your ship is more seaworthy, more capable of taking you where you want to go. It’s the difference between making progress towards your destination vs. just staying put and trying not to capsize. Here are a few specific reasons I believe this is true for most organizations:

1. Retention is either a cascading problem or growth engine in both directions of the donor lifecycle (from acquisition to revenue growth).

For acquisition: It’s a different equation when you pull newly-acquired donors into a retention strategy that consistently generates a high lifetime value. It’s the difference between spending $100 to acquire a donor that might give $150 this year vs. spending that $100 to acquire a donor that might be worth $3,000 over eight years. If your retention metrics are suffering, acquisition programs might be lucky to break even on fundraising costs. If retention metrics are strong, those acquisitions quickly create a sustainable and predictable revenue base for years.

Retention can also be an insights engine to make acquisition programs more impactful. Through experimentation, you might learn that a particular segment is far likelier to have a higher lifetime value (LTV). Even if it costs more to acquire more of that segment on the acquisition side, you might be able to prove that the long-term revenue impact is worth the additional investment.

For revenue growth: Retaining donors for a long period of time does a couple of things. First, donors who stick around for a long time (years or decades) become super fans who talk. They become a source of new donor referrals through their social networks. Second, those long-time donors will progress in their careers and have the potential to grow from mass donors to mid-level donors to major donors if they’re cultivated effectively.

Here’s an example of this from an organization I worked with: An individual donor started giving earlier in their professional journey. This person stuck around giving at modest levels for five years or more, then steadily increased their giving as they built a successful business. Finally, the donor sold their business and in the resulting liquidity event had an opportunity to give substantially to reduce a tax bill, which resulted in an 8-figure donation. That 8-figure gift didn’t come out of the blue. It was the result of a decade-plus of effort to retain this donor first at the mass level, then 1:1 through a relationship with a gift officer. Obviously not all mass donors will convert to 8-figure donors in the future, but some version of this giving growth story is frequently true even at more modest levels. Excellent retention isn’t just about growing your mass donor revenue, it’s about cultivating the next generation of major donors for your organization.

In short: Retention is the lynchpin to sustainable donor acquisition costs as well as a growing major donor pipeline.

2. Retention variables are controllable.

Retention covers the main phase of the donor lifecycle that organizations fully control. In the last decade, the paid media landscape has changed substantially. To name just a few: We’ve seen large increases in the cost of digital advertising and shrinking ROI and ROAS (return on ad spend). The big social platforms regularly change their algorithms, and these changes frequently have a negative impact on acquisition campaign effectiveness. Google’s core search business is threatened by AI summaries and search tools, which has resulted in lower organic search traffic and reduced inventory and reach for Google Ads grant campaigns. None of these elements are within the control of a single organization.

Retention, on the other hand, relies heavily on owned media channels. Think email, SMS, website, apps, and other digital experiences. These are all cost-protected channels, meaning our ability to design thoughtful donor touch points doesn’t change with the fact that our advertising budget suddenly gets us 30% less impressions than it did last year.

Building a solid retention strategy that creates revenue predictability on top of owned media channels puts organizations in control of their own destiny.

Basic compounding retention magic

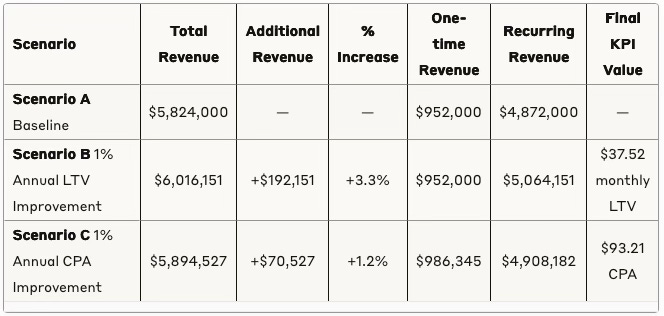

Let’s look at how this plays out using some very simplified, back-of-the envelope math and some ballpark industry benchmarks averaged from a handful of recent studies.1 Here’s the scenario:

Charities A, B and C each have 1,000 existing recurring revenue donors at $35 monthly.

Average recurring donor tenure is 8 years, so we’ll look at these scenarios over an 8-year timeframe.

Each organization invests $100,000 annually to acquire new donors throughout this period and initially acquires new donors at $100 each.

An average one-time gift is $119, and 10% of acquired first-time donors convert to monthly recurring.

Each organization focuses improving performance in a different part of the donor lifecyle:

Organization A does not see any improvements on acquisition or retention metrics (our baseline)

Organization B focuses on improving retention (measured by increasing lifetime value) by 1% each year

Organization C focuses on improving CPA (cost per acquisition of a new donor) by 1% each year

In this overly-simplified scenario, steady retention improvements, measured through LTV, come out on top for revenue impact. The benefits of retention improvements also compound as a recurring-revenue donor base grows. This math also doesn’t include any of the potential downstream lifecycle impacts of increased major gift activity from donors who stick around longer.

This is not a working revenue model by any means (no annual churn included, for example) and it doesn’t account for sector-specific metrics, so plug your own numbers in to make sure this makes sense for your unique context. Retention can get complicated in the real world. Some donors give steadily at the same rate for years. Some pause, re-engage and increase their giving. Others give two big gifts, disappear for 5 years and give again. Still, I like beginning with this level of simplicity because it’s a reminder that the basic human equation for retention is: Does someone feel inspired and compelled to stay and continue giving? For how long, and at what level? That’s what we’re solving for, no matter how many models or fancy stats we might throw at it.

If you have the capacity to think about acquisition and retention simultaneously, that’s the obvious winning combination. But if you have to prioritize, spend some time analyzing the potential outcome differences before you pick a starting point.

Once retention metrics on a steady improvement trajectory, you can confidently focus on acquisition all day long. Before then, think about the donors who are already standing with you and how you can serve them better to unlock sustainable revenue growth for your organization.

In a future newsletter, we’ll look at the ‘how’ behind this retention question with some practical advice and possible starting points. Hit the subscribe button below to get the next article in your inbox.

$35 monthly recurring donation average: NeonOne

$119 average one-time donation: NeonOne

$100 CPA (cost of acquiring a new donor): Blended average rate from multiple sources

8-year median tenure for recurring donors: NeonOne

10% conversion to monthly recurring: Verdata (3% - 15% range)